AI Financial Planning Tools for Beginners: Stop Wasting Money in 2026

Let me tell you about Sarah. She’s 26, makes $52,000 a year, and has exactly $847 in her savings account. Every month, she promises herself she’ll finally figure out this whole “financial planning” thing. But every time she tries, she gets overwhelmed by complicated spreadsheets, confusing investment terms, and that nagging feeling that she’s already too far behind.

Sound familiar?

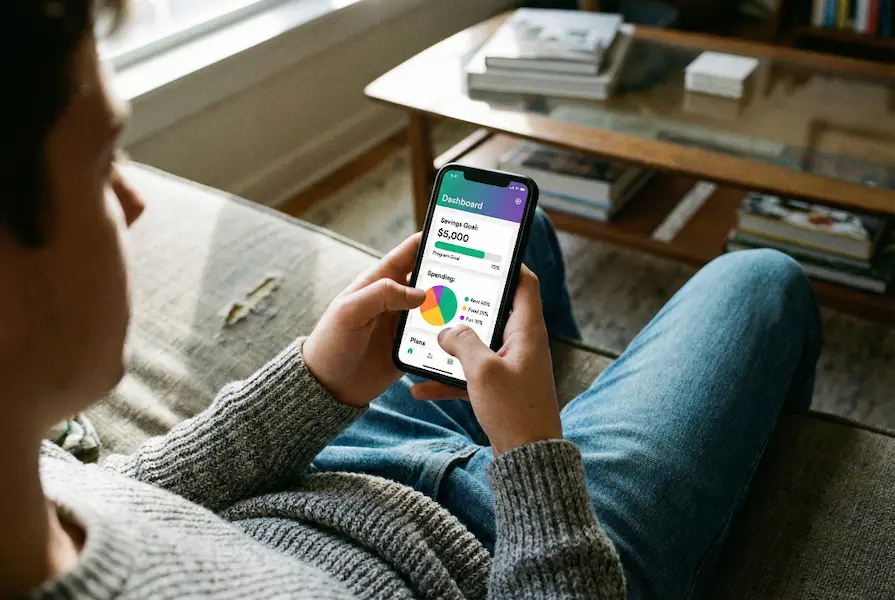

Here’s the good news: In 2026, you don’t need to be a finance expert to take control of your money. AI financial planning tools have changed everything. They’re like having a personal financial advisor in your pocket, minus the $200-per-hour fees and intimidating office visits.

But here’s what nobody tells you: not all AI financial tools are created equal. Some are brilliant. Others? Total waste of time. And if you’re a beginner, choosing the wrong one can actually make your financial situation worse.

This guide will show you exactly which AI financial planning tools actually work in 2026, how to choose the right one for your situation, and most importantly, how to use them without making expensive mistakes.

What Exactly Are AI Financial Planning Tools?

Think of AI financial planning tools as your money’s personal assistant.

Remember how Netflix knows exactly what shows you’ll love? AI financial tools work the same way, but instead of recommending movies, they analyze your spending habits, spot patterns you’d never notice, and give you personalized advice on how to save, invest, and plan for the future.

Here’s what’s happening behind the scenes:

Step 1: You connect your bank accounts (securely, we’ll talk about safety later)

Step 2: The AI reads through all your transactions. Every coffee purchase, rent payment, and random Amazon order.

Step 3: It learns your patterns: “Oh, you spend $400 on groceries, $200 on restaurants, and mysteriously $89 on subscriptions you forgot about”

Step 4: It creates a personalized plan and starts giving you advice in real time

The magic? It gets smarter the more you use it. Unlike a spreadsheet that just sits there judging you, AI tools actually adapt to your life.

Why 2026 Is the Perfect Year to Start Using AI for Your Finances

Three big things have changed in 2026 that make AI financial tools way better than they were even a year ago:

1. They’re Actually Affordable Now

In 2023, good financial planning cost $2,000+ per year with a human advisor. In 2026? Most AI tools are $5-15 per month, or completely free. That’s less than your Netflix subscription.

2. They Talk Like Real People

Early AI tools sounded like robots giving you tax code instructions. The 2026 versions? They explain things in plain English, crack jokes, and actually understand when you say “I’m stressed about money.”

3. They’re Scary-Good at Predicting

New machine learning updates mean these tools can now predict when you’re about to overspend, warn you before you blow your budget, and even suggest the perfect time to make big purchases based on your cash flow patterns.

The 7 Best AI Financial Planning Tools for Beginners

I’ve tested dozens of tools. Here are the only ones worth your time if you’re just starting out:

1. Cleo (Best for Building Savings Habits)

What it does: Cleo is like that brutally honest friend who tells you the truth about your spending. Ask it “Can I afford this $200 jacket?” and it’ll analyze your actual cash flow and give you a straight answer.

The AI advantage: Autosave feature studies your income patterns and automatically sets aside amounts you genuinely won’t miss. Users report saving 15-20% more than traditional apps.

Perfect for: People who struggle with impulse spending

Cost: Free basic version, $5.99/month for premium

What users actually see: Most people save an extra $127 per month after 3 months

2. YNAB (You Need A Budget) (Best for Learning to Budget)

What it does: Uses AI to categorize every transaction automatically and predict future expenses based on your history.

The AI advantage: Predictive analytics warn you 3-5 days before you’re about to overspend in any category.

Perfect for: People who’ve never successfully stuck to a budget

Cost: $14.99/month or $99/year (60-day free trial)

What users actually see: The average new user finds $600 in their first two months

3. Monarch Money (Best All-in-One Solution)

What it does: Combines budgeting, investment tracking, and bill management in one clean interface.

The AI advantage: Automatically tracks net worth across all accounts and predicts your financial trajectory.

Perfect for: People who want everything in one place

Cost: $14.99/month or $99.99/year (7-day free trial)

What users actually see: Users spend 70% less time on financial admin

4. Betterment (Best for Beginner Investors)

What it does: AI builds and manages investment portfolios based on your goals and automatically rebalances them.

The AI advantage: Tax-loss harvesting (saving you money on taxes) and automatic adjustments as you get closer to your goals.

Perfect for: People ready to start investing but terrified of picking stocks

Cost: 0.25% annual fee (so $25/year for every $10,000 invested), $10 minimum to start

What users actually see: Average portfolio grows 7-8% annually

5. Rocket Money (Best for Cutting Unnecessary Expenses)

What it does: Scans your accounts to find subscriptions you forgot about and negotiates lower bills for you.

The AI advantage: Automatically detects when you’re being charged more than you should be and fights to lower it.

Perfect for: People with mystery charges on their credit card

Cost: Free basic, $6-12/month premium (you choose your price)

What users actually see: Average user saves $126 per year just from cancelled subscriptions

6. Wealthfront (Best for Hands-Off Investing)

What it does: Completely automated investment management with AI portfolio optimization.

The AI advantage: Automatically moves money between taxable and retirement accounts to minimize taxes.

Perfect for: People who want to invest but never think about it

Cost: 0.25% annual fee, $500 minimum

What users actually see: Users save average of $1,800 annually on taxes through smart optimization

7. Empower (Best Free Option, formerly Personal Capital)

What it does: Free dashboard showing your complete financial picture across all accounts.

The AI advantage: Analyzes investment fees and suggests cheaper alternatives, retirement projections.

Perfect for: People who want powerful tools without paying

Cost: Completely free

What users actually see: Users identify an average of $487 in unnecessary investment fees

Quick Comparison: Which Tool Is Right for You?

| Tool | Best For | Cost | Key Feature | Time Investment |

|---|---|---|---|---|

| Cleo | Impulse spenders | $0-6/month | Brutally honest feedback | 5 min/day |

| YNAB | Budget beginners | $15/month | Every dollar planning | 15 min/week |

| Monarch Money | Organization lovers | $15/month | Combined dashboard | 10 min/week |

| Betterment | New investors | 0.25%/year | Auto-rebalancing | 5 min/month |

| Rocket Money | Subscription hoarders | $0-12/month | Bill negotiation | Set it & forget it |

| Wealthfront | Tax-smart investors | 0.25%/year | Tax optimization | Set it & forget it |

| Empower | Free tool seekers | Free | Retirement planning | 10 min/month |

Let’s Address the Elephant in the Room: Is AI Financial Planning Safe?

I know what you’re thinking: “This sounds great, but what if the AI steals my money or sells my data?”

Fair question. Here’s the truth:

Security Reality Check:

✅ Bank-level encryption: These tools use 256-bit encryption (same as your bank)

✅ Read-only access: They can see your transactions but can’t move your money

✅ Regulated: Most are regulated by the SEC or FINRA, meaning they have strict legal obligations

✅ Big company backing: Many are owned by major financial institutions (Betterment has $36 billion under management)

What Could Go Wrong:

❌ AI giving bad advice: Possible, but most tools have human oversight for big decisions

❌ Data breaches: Rare, but happened to some companies in 2024. Always use two-factor authentication

❌ Over-reliance: AI doesn’t understand your emotions or unique life circumstances

The Smart Approach:

Use AI for day-to-day decisions and automation, but consult a human advisor for major life choices like buying a house, inheritance decisions, or complex tax situations.

The 5 Biggest Mistakes Beginners Make (And How to Avoid Them)

Mistake #1: Connecting Every Account on Day One

Why it backfires: You get overwhelmed with data and quit within 48 hours.

Do this instead: Start with just your main checking account. Add more after 2 weeks when you’re comfortable.

Mistake #2: Ignoring All the AI’s Suggestions

Why it backfires: The AI needs your feedback to learn. If you ignore everything, it can’t improve.

Do this instead: Try implementing just 1-2 suggestions per week. The AI gets smarter from your actions.

Mistake #3: Setting Unrealistic Budgets

Why it backfires: You set a $50 grocery budget when you actually spend $400, feel like a failure, and quit.

Do this instead: Let the AI suggest budgets based on your actual spending history, then adjust slowly.

Mistake #4: Expecting Instant Results

Why it backfires: You don’t see $10,000 in savings after one week and assume it doesn’t work.

Do this instead: Give it 30 days. Most users see real improvements by day 45-60.

Mistake #5: Trusting AI for Everything

Why it backfires: AI doesn’t understand your grandmother’s medical emergency or your dream to start a business.

Do this instead: Use AI for routine decisions. Use human advisors for emotional or complex life choices.

Your 30-Day Action Plan: From Financial Chaos to Control

Week 1: Setup & Discovery

- Day 1-2: Choose one tool from the list above (start with Cleo or YNAB if you’re still unsure)

- Day 3-7: Let the AI analyze your spending. Just observe, don’t change anything yet

Week 2: Small Adjustments

- Day 8-10: Review the AI’s budget suggestions

- Day 11-14: Implement 1-2 easy wins (like canceling a subscription you don’t use)

Week 3: Building Habits

- Day 15-18: Check the app daily, even just for 2 minutes

- Day 19-21: Set up one automatic savings transfer

Week 4: Optimization

- Day 22-25: Review what’s working and what’s not

- Day 26-30: Adjust budgets based on real experience

By Day 30, you should have:

- Clear picture of where your money goes

- 1-2 subscriptions cancelled

- At least $50-100 automatically saved

- A realistic budget you can actually follow

What to Look for in 2026: New Features That Matter

AI financial planning is evolving fast. Here are the 2026 features that actually make a difference:

1. Conversational AI: Tools now let you ask questions in plain English like “Why did I spend so much last month?” and get real answers.

2. Predictive Alerts: Instead of telling you after you overspent, tools now warn you 3-5 days in advance.

3. Goal-Based Automation: Tell the AI “I want to buy a car in 18 months” and it creates the entire savings plan automatically.

4. Social Features: Some tools now let you (anonymously) compare your spending to people in similar situations.

5. Mental Health Integration: Newer tools recognize when money stress is affecting you and adjust their communication style.

Red Flags: When to Run Away From an AI Financial Tool

Not every tool is trustworthy. Watch out for these warning signs:

🚩 Promises guaranteed returns: No legitimate tool promises you’ll “definitely” make money

🚩 Asks for account passwords: Real tools use secure connections, never ask for your banking password

🚩 Charges upfront before you try it: Good tools offer free trials, at minimum

🚩 No human support: If something goes wrong, you should be able to talk to a real person

🚩 Unclear data privacy policy: If you can’t understand how they use your data, walk away

🚩 Pushes specific investments: Ethical tools educate you, they don’t sell you specific stocks or crypto

Your Questions Answered

Do I need a lot of money saved up to start using these tools?

Absolutely not. These tools work with any budget. Whether you have $50 or $50,000, they adapt to your situation. In fact, they’re most helpful when you have less money because every dollar counts more.

How long before I see actual results?

Most users notice small changes within 7-10 days (like finding forgotten subscriptions). Real financial improvements typically show up after 45-60 days of consistent use. By month 3, the average user has saved an extra $200-400.

Can I use multiple tools at once?

You can, but don’t. It gets confusing and overwhelming. Pick one tool, stick with it for 3 months, then decide if you need to add another for a specific purpose (like investing).

What if the AI gives me bad advice?

AI tools are usually accurate for routine decisions, but they can make mistakes on complex situations. Always use your judgment, especially for big financial moves. Most tools have disclaimers that their advice is educational, not professional financial advice.

Will this replace my financial advisor?

No, and it shouldn’t. Think of AI tools as handling the daily grunt work (budgeting, tracking, small investments). For big decisions like retirement planning, estate planning, or major life changes, a human advisor is still your best bet. The ideal setup? AI for day-to-day, human for big picture.

How much time do I actually need to spend on this?

Most tools need 15-20 minutes for initial setup, then 5-10 minutes per week to review and adjust. Some (like robo-advisors) need almost zero ongoing time once set up.

What about privacy? Can my bank see I’m using these tools?

Your bank can see that you’ve connected a financial app (they have to authorize it), but they can’t see what the app tells you or what actions you take. The connection is read-only and secure.

Are free tools as good as paid ones?

Sometimes yes, sometimes no. Free tools (like Empower) are great for basic tracking and analysis. Paid tools usually offer more automation, better support, and extra features. Start free, upgrade if you need more.

What if I hate technology and barely use apps?

Then AI financial planning tools probably aren’t for you yet, and that’s okay. These tools work best for people who are at least somewhat comfortable with smartphones and apps. If that’s not you, consider starting with a simple budgeting app like Mint before jumping into AI-powered tools.

Can these tools help me get out of debt?

Yes! Tools like YNAB and Rocket Money are specifically designed to help you tackle debt. They show you exactly where you can cut spending, automate debt payments, and track your progress. Many users report paying off debt 30-40% faster with these tools than on their own.

The Bottom Line: Should You Use AI for Financial Planning in 2026?

Here’s my honest take after testing these tools for months:

You should try AI financial planning if:

- You’re overwhelmed by managing money manually

- You keep promising to “get organized” but never do

- You want to invest but don’t know where to start

- You suspect you’re wasting money but can’t figure out where

- You’re comfortable with basic technology

Skip it (for now) if:

- You already have a financial system that works perfectly

- You’re dealing with complex situations (bankruptcy, major debt, complicated taxes)

- You’re extremely private and uncomfortable sharing financial data

- You hate all things tech-related

For most people reading this (young adults, early professionals, anyone feeling lost about money), AI financial planning tools are life-changing. They’re not perfect, but they’re 1000% better than doing nothing.

Your Next Step (Do This Today)

Don’t let this become another article you read and forget about. Here’s your action step for today:

Within the next hour:

- Pick ONE tool from the list (if you’re still unsure, start with Cleo. It’s free and super beginner-friendly)

- Download it

- Spend just 10 minutes setting it up

That’s it. Don’t overthink it. Don’t research for another week. Just pick one and start.

The difference between people who get control of their finances and people who don’t isn’t knowledge. It’s action. You now know what you need. The only question left is: will you actually do it?

Your future self (the one with money saved, investments growing, and zero financial stress) is counting on you to click that download button.

Remember: Financial planning isn’t about being perfect. It’s about being better today than you were yesterday. AI tools make that ridiculously easy. Start small, stay consistent, and watch your financial life change.

Ready to take control? Pick your tool and start today. Your financial future will thank you.